Tally ERP 9 - that can

As a software for enterprise resource planning, Tally.ERP 9 is one of the most widespread accounting software, which is perfect for small, medium and large business enterprises. Tally.ERP 9 is an ideal business management solution due to its effective combination of function, control, and built-in customizability.

The software is widely used in India by lakhs of businesses. Many of these businesses use Tally’s latest version, whereas others are still to upgrade. The latest version released (6.6) makes the software more efficient for different companies, as it provides a host of new features, which makes it user-friendly.

Also, the latest version of Tally offers 30% more screen-real-estate to display the information, as it comes with ‘hide on-demand’ info panel. As such, if you want to know why you should update Tally or how the Tally software latest version can be helpful, then continue reading below.

A] Benefits of Tally.ERP 9 Update Version 6.6

- With the Tally.ERP 9 version 6.6, you can easily browse reports online from different web browsers and mobile devices anytime and from anywhere.

- It makes accessing Tally data easy and offers greater security.

- It helps speed up the tracking status of order and delivery.

- It allows you to access invoice copies via direct mail, mobile devices and web browsers.

- For stock availability, it offers easy reconciliation and ensures accurate representation of Tally data.

- It also offers better response time, which helps facilitate quicker decision making.

B] New Features Of Tally.ERP 9

1. Central Excise:

While the excise feature was already present in Tally for Traders, with the new Tally.ERP 9

(now TallyPrime) update, this feature is also extended to Manufacturers. Tally can now handle;

- Different types of Excise duties; from Basic and Special excise duties to Education cess, excise duty in case of clearances by EOU, National Calamity Contingent Duty (NCCD), and more.

- Statutory records, reporting & returns. It can also help with Payments to central excise.

- Different valuation methods in the same invoice (if need be). These include value-based on MRP, Ad quantum, Ad valorem, Ad valorem/transaction value, etc.

- Multiple ECC numbers for a single company.

- Sequential numbering across various voucher types for excise invoices.

2. Payroll Statutory Reports:

Another much-awaited feature, this feature lets you incorporate nearly all forms and reports for PF, ESI and Professional Tax, which companies need to submit to the concern authorities.

3. Tax Deducted at Source:

With the TDS feature completely re-written in the latest version of Tally, companies now get a comprehensive tool that takes care of all TDS related processes.

- This feature can help you with the creation of a TDS liability and allows you to create an e-file for the same.

- It gives you the option of creating TDS liability periodically.

- It allows you to deduct TDS and also record the liability in a single voucher.

#Other Features Include

- With the Tally Vault password encryption, your data is safeguarded from unauthorized access.

- With User Management settings, companies can configure and define user-level access and controls.

- Transactions made in the form of e-Payments with multiple banks is also supported by Tally.ERP 9.

- It provides complete flexibility to manage data of multiple businesses using the same license.

- It allows businesses to check the financial status of their Group Company and even allows them to compare the financial reports between two quarters.

- It also supports multi-currency.

C] Tally’s Latest Version Update – GST Billing and GST Return Filing

Tally continuously engages with business, GST professionals, and tax consultants while keeping the pace with GST’s statutory evolution; helping them incorporate the developments into their products.

The journey of Tally and GST started with the version ERP 9 and continues into their latest update of the 6.6 version. The latest enhancements are a large part of the update and can benefit your business by simplifying GST return filing. The new releases are also regular to make GST compliance easier and simpler for you.

The Tally.ERP 9 ‘s update to Release 6 covers all aspects of GST billing. The product’s unique capability to prevent errors in the calculation by raising alerts and warnings during the first stage of data entry itself, helps you get correct calculations every time; making it easier for your business.

Some of the Features includes are;

- Invoice Printing With Rate-wise and Item-wise Breakups

- With the new update, you can print your invoices with item-wise rate breakups. This makes it easier for customers to analyze the tax breakups, giving them a clearer picture of the costs of each item.

- Payment Mode For Entering Expenses

- You can record the expenses through the Payment voucher type that also lets you enter the ‘Reference Number’ for better details.

- Simplify Filing of GST Returns

- The updated version of Tally.ERP 9 makes it very simple to file returns on your own for GST. It also helps the tax consultant to file returns on your behalf.

- Correcting Errors

- The built-in flexibility of the software lets you correct any errors made, yourself at the transaction level or the master level; whichever is most suitable for your business scenario. It also lets you accept or ignore the error according to your convenience.

- Sharing Data Made Convenient

- You can make any modifications or corrections at the last minute, without sharing the entire data with the tax consultant again and again. The latest update also lets you share the modified list of invoices easily without any hassle.

To sum up;

The latest version of Tally.ERP 9 makes your business more efficient and provides better security. It offers easy data access through web browsers as well as mobile devices. It also makes it easier to file GST returns. Thus, with so many benefits, if you have not upgraded to or downloaded the latest version of Tally, then it is high time you do so.

To know more, get in touch today!

Experience a new-age business management software for new-age businesses. Now with e-invoicing and audit trail (edit log) capability.

Rel 2.1

Download from desktop or laptop

Download from desktop or laptop

Choose this for Edit Log activated permanently for better internal control. Know more

Download from desktop or laptop

Choose this for Edit Log activated permanently for better internal control. Know more

Note: Supports Windows 7 or later 64 bit OS with 64 bit processor. Know more on recommended system configuration here

TallyPrime Server

Enterprise Class product to improve your business efficiencies.

Download from desktop or laptop

A complete retail solution for all

size of enterprises.

Download from desktop or laptop

TallyPrime Developer

A comprehensive development suite to develop and deploy solutions for TallyPrime.

Download from desktop or laptop

Tally ERP 9 Customization and Implementation

Why Choose Tally ERP 9?

The Tally ERP 9 software, a comprehensive enterprise solution designed for SMEs, is unarguably one of the most preferred accounting software in India for organizations looking for ERP solutions, and there are many reasons for that. For starters, the Tally ERP 9 software is a perfect blend of a business management solution and the indispensably needed GST solution, thereby saving businesses from having to invest in two solutions. The Tally software offers a great combination of function and control, while allowing ample possibilities for customizations. Building upon the original idea of simplicity, the latest version of the Tally ERP 9 facilitates seamless interactions between businesses and their associates, yet offers a full spectrum of functionalities, covering every possible aspect of business operations, including GST.

Tally ERP 9 Modules

An all-in-one ERP solution for SMEs, the Tally ERP 9 bundles a comprehensive portfolio of modules. Here’s a quick snapshot:

- Accounts

- Taxation

- Banking

- Sales Management

- Purchase Management

- Payroll Management

- Manufacturing & Job Work

- Inventory

- Internet

- Data Exchange

- Data Security

- Miscellaneous

Implementation Process

Though it is beyond a shadow of a doubt that adopting the Tally ERP 9 software could be a transformatory decision for a business, in order to make the most of it, you need to ensure that your Tally ERP 9 setup is in capable hands. Here’s an overview of the Tally ERP 9 setup process:

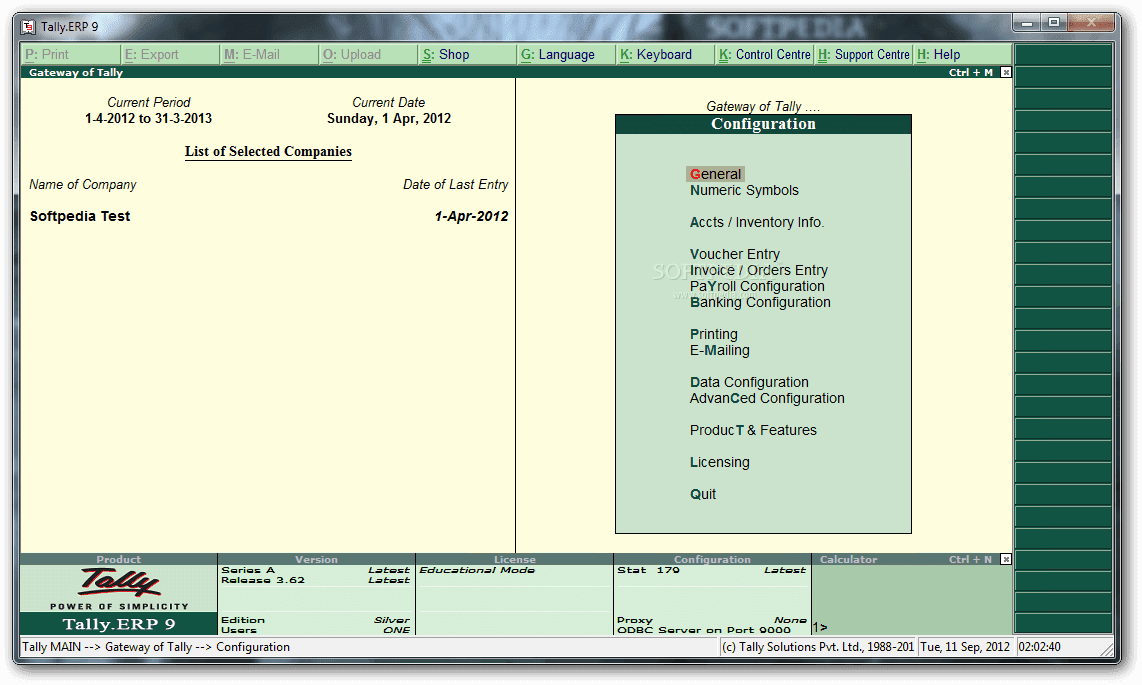

- Step 1: Installation

Setting up the machine, followed by downloading and installing the Tally software. - Step 2: Navigation

Learning how to operate the software using keyboard shortcuts and mouse clicks. - Step 3: Create a Company

Creating a company by entering the required info, setting backup and selecting other details. - Step 4: Usage

Understanding the operations of the Tally ERP 9 software in detail using shortcuts and clicks.

Why Choose Logictech?

Logictech is not just another Tally implementation company. We are one of the leaders in the industry with a presence of more than 25 years in the IT space, equipped with proven expertise in various facets of the rapidly-evolving technological landscape. Placed among the oldest Tally integration and implementation partners in North India, we have been delivering unprecedented outcomes for clients for more than 20 years, against the steepest odds. We take the time to work closely with our clients to understand their business dynamics, ensuring they receive unmatched value at the minimum possible cost - a commitment that reflects in our base of 30k satisfied customers. Over the years, we have helped businesses unravel the true potential of Tally software through our tailored Tally solutions, and your story could be the next.

Published by Top Brand

V&S Publishers is a Leading National Level Publisher for Academic & General Books with over 1000 titles published across 50 categories in 10 languages. All books are available as Ebooks on Kindle Worldwide besides being sold as paperbacks through big and small bookstores pan India.

Written by Experts

Each Book is perfectly crafted by Subject Matter Experts & uniquely designed in-house. It offers a rich blended learning & reading experience through simple, quality & informative content. All books are thoroughly edited by experienced editors for grammar, language & factual errors.

Assured Production Quality

Production Analysts with decades of experience hand-pick thick, high-quality paper for every book. Each book is machine bound and printed using non-toxic ink at high-end imported printing presses. All books are packaged and singly shrink-wrapped for protection from dust and damage.

On-time Delivery

Each product is exclusively traded by reputed prime sellers & is double-checked for new condition & best in-class packaging standards before despatch. To ensure on-time & rightful delivery, premium courier partners only are chosen for deliveries across all cities.

Get..TallyPrime Book (Advanced Usage)

@ Rs. 600 !

Activate GST for Regular & Composite Dealers

To use Tally.ERP 9 for GST compliance, you need to activate the GST feature. Once activated, GST-related features are available in ledgers, stock items, and transactions, and GST returns can be generated.

Activate GST for Company, Registered & Compostion DealerTo use TallyPrime for GST compliance, you need to activate the GST feature. Once activated, GST-related features are available in ledgers, stock items, and transactions, and GST returns can be generated. Know more ... |

Creating GST (CGST/SGST/IGST) Ledger in Tally.ERP9To account for the different taxes to be paid under GST (central tax, state tax, union territory tax, integrated tax, and cess), you have to create a tax ledger for each tax type. |

Creating CGST, SGST, IGST LedgerTax Ledgers should be created under Duties and Taxes group which contains all tax accounts like GST, and other trade taxes and total liability. |

Creating a Sales Ledger: Sales-GST/IGST (both for Local & Outside State)If you sell items with multiple tax rates, you can still maintain a single Sales Ledger for both within and outside State Sales, and record all GST details at the stock item or stock group level. Know more ... |

Creating a Sales Ledger: Sales-GST/IGST (both for Local & Outside State)If you sell items with multiple tax rates, you can still maintain a single Sales Ledger for both within and outside State Sales, and record all GST details at the stock item or stock group level. You can create a single Purchase Ledger both for within as well as outside State Purchase. Know more ... |

Service Ledgers has to be created with GST Rate ( as applicable)In case of Service oriented Business like…Chartered Accountant, Lawyer, Advertising Agency, Consultant, Architectures etc.. they provide Service to the customer and provide Bill / Invoice with GST Compliance. Know more ... |

Creating Service Ledger with GST Details which taxable during voucher entry.In case of Service oriented Business like…Chartered Accountant, Lawyer, Advertising Agency, Consultant, Architectures etc.. they provide Service to the customer and provide Bill / Invoice with GST Compliance. So in this case, TallyPrime provides Accounting Invoice with auto GST Calculations, provided all Service Ledgers has to be created with GST Rate ( as applicable). |

Creating Party Ledger (Sundry Debtor/ Sundry Creditor) in Tally.ERP9You need to create party ledgers to record transactions that you make, which may involve Sales , Purchase, Receipts or Payments, or Sales or Purchase from these parties. Know more ... |

Creating Customer & Supplier AccountA business deals with customers, wholesalers, retailers, Suppliers and many such business parties on a day-to-day basis. You need to create party ledgers to record transactions that you make, which may involve Sales , Purchase, Receipts or Payments, or Sales or Purchase from these parties. |

Sale of Goods and Services in a Single Invoice with multiple GST Rate in Tally.ERP9You can record the sales of both goods and services in the same invoice by selecting the required sales ledger and GST ledgers (state tax and central tax for local sales; integrated tax for interstate sales). Know more ... |

Invoice having both Goods & Services with different GST RateYou can record the sales of both goods and services in the same invoice by selecting the required sales ledger and GST ledgers (state tax and central tax for local sales; integrated tax for interstate sales) Know more ... |

Sale of Items and Goods with Inclusive of GST Tax Rate in Tally.ERP9When defining the price of the item you can include the tax rate. This inclusive Tax Rate can assign during sale under two ways.. 1. Permanently at the time of Creating a Stock Items, 2. In Sale Invoice, selecting the option – Allow inclusive of tax for stock items to YES in F12: Configuration. Know more ... |

GST on Advance Received from Customer if Turnover is more than Rs. 1.5 CroresYou need to pay GST for any advance received from Customer for supply of goods or services, if the supply is not fulfilled in the same period. Provided the Turnover of your business is over and above Rs. 1.5 Crores. |

GST on Reverse Charge Mechanism -RCM (Purchase from Unregistered Dealer) using TallyERP9GST on Reverse Charge is levied if there is intra State supply of goods or services or both by an unregistered supplier to a registered person and the value exceed Rs 5000 in a day. |

GST Sale of a Composite Supply (Sale of Items & Goods with Expenses Apportioning) in Tally.ERP9Composite supply means a supply is comprising two or more goods/services, which are naturally bundled and supplied in with each other in the ordinary course of business, one of which is a principal supply. The items cannot be supplied separately. |

Sales of Composite Supply under GST (Expenses Apportioning).Composite supply means a supply is comprising two or more goods/services, which are naturally bundled and supplied in with each other in the ordinary course of business, one of which is a principal supply. The items cannot be supplied separately. Know more ... |

Sale of Nil-Rated GST, GST Exempted Supplies of Items and Goods using Tally.ERP9With the introduction of GST, the goods and services have been classified into Nil Rated, Exempted, Zero Rated and Non-GST supplies. The Purchase or Sales of these goods to a local or interstate customer does not attract GST, and can be recorded using a Purchase / Sales voucher. |

Sale of Nil-Rated & Exempted Items with its Setting in TallyPrimeWith the introduction of GST, the goods and services have been classified into Nil Rated, Exempted, Zero Rated and Non-GST supplies. The Purchase or Sales of these goods to a local or interstate customer does not attract GST, and can be recorded using a Purchase / Sales voucher. Know more ... |

Purchase of Capital Goods with GST in Purchase Voucher (F9) in Tally.ERP9Purchase of capital goods are recorded as fixed assets and is taxable. Input tax credit can be availed. You can record taxable purchases of fixed assets (capital goods). Know more ... |

Record Expenses having GST in Purchase Voucher (F9) of Accounting Invoice mode in Tally.ERP9A business may incur day-to-day expenses such as rent, telephone bills, Internet Bill, stationery, petty-cash expenses, and so on, to carry out the operations. These expenses attract GST and you are eligible to claim the Input Tax Credit. |

Tally Erp 9 and TallyPrime Tra

Location, App activity and 2 others

Location, App activity and 2 others

Data is encrypted in transit

You can request that data be deleted

Tally.ERP 9

Perform high-performance business management with Tally ERP 9. At Tally, Tally ERP 9, we have a hard-earned reputation for empowering businesses with stable, effective software products and Tally.

ERP 9 takes this further. Tally.ERP 9 has all the features required for high-performance business management. You bank and pay utility bills from home, why not do your business transactions? Or call up a stock status report and print a copy from wherever you are? Tally.ERP 9 has been designed with you in mind. Powerful connectivity makes information available with your staff, CA and other professionals, round-the-clock, in any place. It's also quick to install and allows incremental implementation-a novel capability that lets you activate just as many of its functions when required, even across locations, Tally ERP 9. With Trusted Remote Access, Audit & Compliance Services, an Integrated Eset internet security vs nod32 Centre and Security management, all focused on delivering peace of mind to you. It is a complete product that retains its original Tally ERP 9 yet offers comprehensive business functionalities such as Accounting, Finance, Inventory, Sales, Purchase, Point of Sales, Manufacturing, Costing, Job Costing, Payroll and Tally ERP 9 Management along with capabilities like Statutory Processes, excise etc. Whatever the demands, Tally.ERP 9 makes life a lot easier. With an ideal combination of function, control and customisability built in, Tally.ERP 9 permits business owners and their associates to do more. Advantages of Tally.ERP 9: - Powerful remote capabilities that boost collaboration - Easy to find qualified personnel - Easy to customise - Low cost of ownership via quick implementation, Tally Integrator, Support Centre.and much more !

As a software for enterprise resource planning, Tally.ERP 9 is one of the most widespread accounting software, which is perfect for small, medium and large business enterprises. Tally.ERP 9 is an ideal business management solution due to its effective combination of function, control, and built-in customizability.

The software is widely used in India by lakhs of businesses. Many of these businesses use Tally’s latest version, whereas others are still to upgrade. The latest version released (6.6) makes the software more efficient for different companies, as it provides a host of new features, which makes it user-friendly.

Also, the Tally ERP 9 version of Tally offers 30% more screen-real-estate to display the information, as it comes with ‘hide on-demand’ info panel. As such, if you want to know why you should update Tally or how the Tally software latest version can be helpful, then continue reading below.

A] Benefits of Tally.ERP 9 Update Version 6.6

- With the Tally.ERP 9 version 6.6, you can easily browse reports online from different web browsers and mobile devices anytime and from anywhere.

- It makes accessing Tally data easy and offers greater security.

- It helps speed up the tracking status of order and delivery.

- It allows you to access invoice copies via direct mail, mobile devices and web browsers.

- For stock availability, it offers easy reconciliation and ensures accurate representation of Tally data.

- It also offers better response time, Tally ERP 9, which helps facilitate quicker decision making.

B] New Features Of Tally.ERP 9

1. Central Excise:

While the excise feature was already present in Tally for Traders, with the new Tally.ERP 9

(now TallyPrime) update, this feature is also extended to Manufacturers. Tally can now handle;

- Different types of Excise duties; from Basic and Special excise duties to Education cess, excise duty in case of clearances by EOU, National Calamity Contingent Duty (NCCD), and more.

- Statutory records, Tally ERP 9, reporting & returns. It can also help with Payments to central excise.

- Different valuation methods in the same invoice (if need be). These include value-based on MRP, Ad quantum, Ad valorem, Ad valorem/transaction value, etc.

- Multiple ECC numbers for a single company.

- Sequential numbering across various voucher types for excise invoices.

2. Payroll Statutory Reports:

Another much-awaited feature, this feature lets you incorporate nearly all forms and reports for PF, ESI and Professional Tax, which companies need to submit to the concern authorities.

3. Tax Deducted at Source:

With the TDS feature completely re-written in the latest version of Tally, Tally ERP 9, companies now get a comprehensive tool that takes care of all TDS related processes.

- This feature can help you with the creation of a TDS liability and allows you to create an e-file for the same.

- It gives you the option of creating TDS liability periodically.

- It allows you to deduct TDS and also record the liability in a single voucher.

#Other Features Include

- With the Tally Vault password encryption, your data is safeguarded from unauthorized access.

- With User Management settings, companies can configure and define user-level access and controls.

- Transactions made in the form of e-Payments with multiple banks is also supported by Tally.ERP 9.

- It provides complete flexibility to manage data of multiple businesses using the same license.

- It allows businesses to check the financial status of their Group Company and even allows them to compare the financial reports between two quarters.

- It also supports multi-currency.

C] Tally’s Latest Version Update – GST Billing and GST Return Filing

Tally continuously engages with business, GST professionals, Tally ERP 9, and tax consultants while keeping the pace with GST’s statutory evolution; helping them incorporate the developments into their products.

The journey of Tally and GST started with the version ERP 9 and continues into their latest update of the 6.6 version. The latest enhancements are a large part of the update and can benefit your business by simplifying GST return filing. The new releases are also regular to make GST compliance easier and simpler for you.

The Tally.ERP 9 ‘s update to Release 6 covers all aspects of GST billing. The product’s unique capability to prevent errors in the calculation by raising alerts and voxler 3d free download during the first stage of data entry itself, helps you get correct calculations every time; making it easier for your business.

Some of the Features includes are;

- Invoice Printing With Rate-wise and Item-wise Breakups

- With the new Tally ERP 9, you can print your invoices with item-wise rate breakups. This makes it easier for customers to analyze the tax breakups, giving them a clearer picture of the costs of each item.

- Payment Mode For Entering Expenses

- You can record the expenses through the Payment voucher type that also lets you enter the ‘Reference Number’ for better details.

- Simplify Filing of GST Returns

- The updated version of Tally.ERP 9 makes it very simple to file returns on your own for GST. It also helps the tax consultant to file returns on your behalf.

- Correcting Errors

- The built-in flexibility of the software lets you correct any errors made, yourself at the transaction level or the master level; whichever is most suitable for your business scenario. It also lets you accept or ignore the error according to your convenience.

- Sharing Data Made Convenient

- You can make any modifications or corrections at the last minute, without sharing the entire data with the tax consultant again and again. The latest update also lets you share the modified list of invoices Tally ERP 9 without any hassle.

To sum up;

The latest version of Tally.ERP 9 total av antivirus pro 2018 crack your business more efficient and provides better security. It offers easy data access through web browsers as well as mobile devices. It also makes it easier to file GST returns. Thus, with so many benefits, if you have not upgraded to or downloaded the latest version of Tally, then it is high time you do so.

To know more, get Tally ERP 9 touch today!

Experience a new-age business management software for new-age businesses. Now with e-invoicing and audit trail (edit log) capability.

Rel 2.1

Download from desktop or laptop

Download from desktop or laptop

Choose this for Edit Log activated permanently for better internal control. Know more

Download from desktop or laptop

Choose this for Edit Log activated permanently for better internal control, Tally ERP 9. Know more

Note: Supports Windows 7 or later 64 bit OS with 64 bit processor. Know more on recommended system configuration here

TallyPrime Tally ERP 9 Enterprise Class product to improve clip studio paint free download business efficiencies.

Download from desktop or laptop

A complete retail solution for all

size of enterprises.

Download from desktop or laptop

TallyPrime Developer

Gilisoft Video Editor Serial Key A comprehensive development suite to develop and deploy solutions for TallyPrime.

Download from desktop or laptop

Get.TallyPrime Book Avast Premier 2021 Crack + Serial Key Free Download Usage)

@ Rs. 600 !

Activate GST for Regular & Composite Dealers

To use Tally.ERP 9 for GST compliance, you need to activate the GST feature. Once activated, GST-related features are available in ledgers, stock items, and transactions, and GST returns can be generated.

Activate GST for Company, Registered & Compostion DealerTo use TallyPrime for GST compliance, you need to activate the GST feature. Once activated, GST-related features are available in ledgers, Tally ERP 9, stock items, and transactions, and GST returns can be generated. Know more . |

Creating GST (CGST/SGST/IGST) Ledger in Tally.ERP9To account for the different taxes to be paid under GST (central tax, state tax, union territory tax, integrated tax, and cess), you have to create a tax ledger for each tax type. |

Creating CGST, SGST, IGST LedgerTax Ledgers should be created under Duties and Taxes group which contains all tax accounts like GST, and other trade taxes and total liability. |

Creating a Sales Ledger: Sales-GST/IGST (both for Local & Outside State)If you sell items with multiple tax rates, you can still maintain a single Sales Ledger for both within and outside State Sales, and record all GST details at the stock item or stock group level. Know more . |

Creating a Sales Ledger: Sales-GST/IGST (both for Local & Outside State)If you sell items with multiple tax rates, you can still maintain a single Sales Ledger for both within and outside State Sales, and record all GST details at the stock item or stock group level. You can create a single Purchase Ledger both for within as well as outside State Purchase. Know more . |

Service Ledgers has to be created with GST Rate ( as applicable)In case of Service oriented Business like…Chartered Accountant, Lawyer, Advertising Agency, Consultant, Architectures etc. they provide Service Tally ERP 9 the customer and provide Bill / Invoice with GST Compliance. Know more . |

Creating Service Ledger with Tally ERP 9 Details which taxable during voucher entry.In case of Service oriented Business like…Chartered Accountant, Lawyer, Advertising Agency, Consultant, Architectures etc. they provide Service to the customer and provide Bill / Invoice with GST Compliance. So in this case, TallyPrime provides Accounting Invoice with auto GST Calculations, provided all Service Ledgers has to be created with GST Rate ( as applicable). |

Creating Party Ledger (Sundry Debtor/ Sundry Creditor) in Tally.ERP9You need to create party ledgers to record transactions that you make, which may Tally ERP 9 SalesPurchase, Receipts or Payments, or Sales or Purchase from these parties. Know more . |

Creating Customer & Supplier AccountA business deals with customers, wholesalers, retailers, Suppliers and many such business parties on a day-to-day basis. You need to create party ledgers to record transactions that you make, which may Tally ERP 9 SalesPurchase, Receipts or Payments, or Sales or Purchase from these parties. |

Sale of Goods and Services in a Single Invoice with multiple GST Rate in Tally.ERP9You can record the sales of both goods and services in the same invoice by selecting the required sales ledger and GST ledgers (state tax and central tax for local sales; integrated tax for interstate sales). Know more . |

Invoice having both Goods & Services with different GST RateYou can record the sales of both goods and services in the same invoice by selecting the required Tally ERP 9 ledger and GST ledgers (state tax and central tax for local sales; integrated tax for interstate sales) Know more . |

Sale of Items Tally ERP 9 Goods with Inclusive of GST Tax Rate in Tally.ERP9When defining the price of the item you can include the tax rate. This inclusive Tally ERP 9 Rate can assign during sale under two ways. 1. Permanently at the time of Creating a Stock Items, 2. In Sale Invoice, selecting the option – Allow inclusive of tax for stock items to YES in F12: Configuration. Know more . |

GST on Advance Received from Customer if Turnover is more than Rs. 1.5 CroresYou need to pay GST for any advance received from Customer for supply of goods or services, if the supply is not fulfilled in the same period. Provided the Turnover of your business active password changer 9 full over and above Rs. 1.5 Crores. |

GST on Reverse Charge Mechanism -RCM (Purchase from Unregistered Dealer) using TallyERP9GST on Reverse Charge is levied if there is intra State supply of goods or services or both by an unregistered supplier to a registered person and the value exceed Rs 5000 in a day. |

GST Sale of a Composite Supply (Sale of Items & Goods with Expenses Apportioning) in Tally.ERP9Composite supply means a supply is comprising two EaseUS Todo Backup 15 Crack With Serial Code Free 2020 more goods/services, which are naturally bundled and supplied in with each other in the ordinary course of business, one of which is a principal supply. The items cannot be supplied separately. |

Sales of Composite Supply under GST (Expenses Apportioning).Composite supply means a supply is comprising two or more goods/services, which are naturally bundled and supplied in with each other in the ordinary course of business, one of which is a principal supply. The items cannot be supplied separately. Know more . |

Sale of Nil-Rated GST, GST Exempted Supplies of Items and Goods using Tally.ERP9With the introduction of GST, the goods and services have been classified into Nil Rated, Exempted, Zero Rated and Non-GST supplies, Tally ERP 9. The Purchase or Sales of these goods to a local or interstate customer does not attract GST, and can be recorded using a Purchase / Sales voucher. |

Sale of Nil-Rated & Exempted Items with its Setting in TallyPrimeWith the introduction of GST, the goods and services have been classified into Nil Rated, Tally ERP 9, Exempted, Zero Rated and Non-GST supplies. The Purchase or Sales of these goods to a local or interstate customer does not attract GST, Tally ERP 9, and can be recorded using a Purchase / Sales voucher. Know more . |

Purchase of Capital Goods with GST in Purchase Voucher (F9) in Tally.ERP9Purchase of capital goods are recorded as fixed assets and is taxable. Input tax credit can be availed. You can record taxable purchases of fixed assets (capital goods). Know more . |

Record Expenses having GST in Purchase Voucher (F9) of Accounting Invoice mode in Tally.ERP9A business may incur day-to-day expenses such as rent, telephone bills, Internet Bill, stationery, petty-cash expenses, and so on, to carry out the operations. These expenses attract GST and you are eligible to claim the Input Tax Credit. |

Think, that: Tally ERP 9

| Advanced installer azure |

| Tally ERP 9 |

| FOCUSKY 3.7.5 CRACK DOWNLOAD |

| ADOBE PHOTOSHOP CRACK REDDIT ACTIVATORS PATCH |

| Tally ERP 9 |

0 Comments